Hard Money Georgia Fundamentals Explained

Wiki Article

What Does Hard Money Georgia Mean?

Table of ContentsHard Money Georgia Can Be Fun For AnyoneThe smart Trick of Hard Money Georgia That Nobody is DiscussingUnknown Facts About Hard Money Georgia6 Easy Facts About Hard Money Georgia Shown

Given that hard money loans are collateral based, also referred to as asset-based financings, they call for very little documentation and also allow investors to close in a matter of days. Nevertheless, these loans featured more threat to the loan provider, as well as for that reason need greater down settlements as well as have higher rates of interest than a conventional funding.Lots of standard lendings may take one to two months to close, however difficult cash fundings can be closed in a few days.

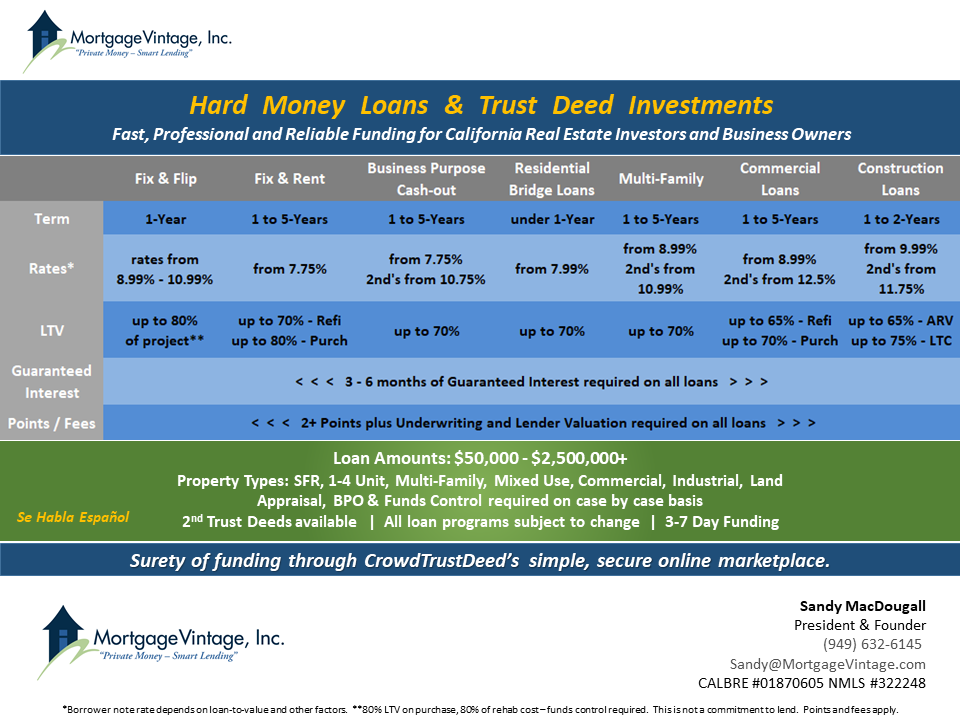

Most difficult cash fundings have short payment periods, generally in between 1-3 years. Conventional mortgages, in contrast, have 15 or 30-year payment terms typically. Tough cash fundings have high-interest rates. The majority of hard money loan rate of interest are anywhere between 9% to 15%, which is significantly more than the rates of interest you can anticipate for a traditional mortgage.

This will certainly consist of getting an evaluation. You'll receive a term sheet that describes the funding terms you have actually been approved for. Once the term sheet is signed, the loan will be sent to processing. During financing processing, the lender will ask for documents as well as prepare the lending for final financing testimonial and routine the closing (hard money georgia).

Little Known Questions About Hard Money Georgia.

In significance, because people or corporations give tough money car loans, they aren't subject to the same guidelines or limitations as financial institutions and also credit rating unions. This implies you can get distinct, directly tailored difficult money finances for your details demands. That stated, tough money lendings have some negative aspects to maintain in mind before seeking them out.You'll require some capital upfront to qualify for a difficult cash car loan and also the physical residential property to serve as security. In addition, tough cash fundings generally have greater interest prices than conventional home mortgages.

Usual departure strategies consist of: Refinancing Sale of the possession Payment from other source There are several scenarios where it may be beneficial to make use of a hard money financing. For beginners, investor who such as to house flip that is, buy a rundown house in requirement of a lot of job, do the work personally or with professionals to make it better, after that reverse as well as market it for a greater cost than they bought for may find hard money financings to be excellent financing alternatives.

Due to this, specialist house flippers typically like short-term, fast-paced funding options. Home fins normally attempt to market houses within much less than a year of acquiring them. Due to this, they do not require a long term and also can stay clear of paying excessive passion. If you acquire financial investment buildings, such as rental buildings, you home might likewise find difficult cash finances to be good options.

Indicators on Hard Money Georgia You Need To Know

Sometimes, you can additionally utilize a hard money loan to acquire vacant land. This is an excellent alternative for developers that are in the procedure of getting approved for a construction funding. Note that, also in the above scenarios, the potential negative aspects of hard cash fundings still use. You need to be sure you can settle a hard cash finance before taking it out.

Hard money car loans typically come with higher rate of interest and shorter settlement schedules. So, why pick a difficult money car loan over a standard one? To answer that, we need to first take into consideration the benefits and also disadvantages of tough money financings. Like every financial device, hard cash loans featured benefits as well as downsides.

The Hard Money Georgia Statements

Additionally, since private people or non-institutional lenders use difficult money finances, they are not subject to the very same policies as conventional loan providers, that make them much more dangerous for consumers. Whether a difficult cash car loan is right for you depends on your circumstance. Difficult cash lendings are good alternatives if you were refuted a standard finance and also require non-traditional financing.Get in touch with the expert home mortgage consultants at Right Beginning Home Loan. hard money georgia to find out more. Whether you desire to buy or re-finance your home, we're right here to help. Start today! Ask for a complimentary individualized rate quote.

The application procedure will usually involve an evaluation of the home's value as well as possibility. This way, if you can not afford your repayments, the difficult cash lender will just move in advance with offering the residential property to redeem its investment. Tough cash lenders typically bill higher rate of interest prices than you would certainly carry a conventional car loan, however they also fund their loans a lot more swiftly as well as normally call for much less documents.

As opposed to having 15 to thirty years to settle the loan, you'll typically have just one to five years. Hard cash fundings work rather in different ways than conventional car loans so it is necessary to understand their terms as well as what purchases they can be used for. Tough cash loans are normally intended for investment properties.

Report this wiki page